Day Hagan Smart Sector® Fixed Income Strategy Update January 2026

A downloadable PDF copy of the Article:

Day Hagan Smart Sector® Fixed Income Strategy Update January 2026 (pdf)

Executive Summary

Global fixed income markets shifted decisively in December, driven by the synchronized dovish pivot of Western central banks. The dominant theme was the "bull steepening" of yield curves in developed markets—a scenario in which short-term interest rates fall faster than long-term rates, steepening the yield curve. This occurred as the Federal Reserve and the European Central Bank each delivered 25 basis-point rate cuts; short-term yields dropped in response to policy relief, while long-term yields declined at a more measured pace, reflecting improved growth expectations rather than deep recessionary fears.

Corporate credit markets benefited from this environment. With borrowing costs falling and economic data stabilizing, credit spreads—the premium investors demand to hold corporate debt over safer government bonds—tightened across both Investment Grade and High Yield sectors. Institutional inflows surged into corporate bonds as investors rushed to lock in attractive coupons before yields compressed further. This demand absorbed new issuance easily, reflecting strong liquidity conditions.

Japan remained the outlier. The Bank of Japan’s rate hike to 0.75% raised Japanese Government Bond (JGB) yields, diverging from the global trend and putting upward pressure on domestic borrowing rates.

Looking toward 2026, the primary influence on fixed income will be the "pace versus destination" of monetary easing. Investors will closely monitor inflation data to see if the projected path of rate cuts is sustainable. Additionally, sovereign supply will be a critical factor; high levels of government debt issuance in the US and Europe could test market appetite, potentially putting upward pressure on term premiums even as policy rates decline.

Holdings

Fixed Income Sector

US 1-3 Month T-bill

US 3-7 Year Treasury

US 10-20 Year Treasury

TIPS (short-term)

US Mortgage-Backed

US Floating Rate

US Corporate

US High Yield

International Corporate Bond

Emerging Market Bond

Outlook (relative to benchmark)

Neutral

Neutral

Underweight

Underweight

Overweight

Overweight

Overweight

Overweight

Underweight

Overweight

Position Details

U.S. Treasuries: U.S. long Treasuries show a mixed but slightly cautious profile. On the negative side, relative strength versus key technical crossovers and the equity market trend remains weak, indicating bonds are lagging risk assets. Signals tied to inflation expectations are also unfavorable, suggesting that elevated or sticky inflation continues to limit demand for duration. In addition, the relationship to credit default swap conditions is negative, implying investors are not actively seeking long-dated Treasuries as a hedge against credit stress. On the more neutral side, technical momentum has stabilized, suggesting that selling pressure may be easing. Taken together, the indicators point to an environment where long Treasuries are not strongly favored, but downside signals are not accelerating. This supports a broadly neutral stance.

Commentary: December performance was pressured by conflicting forces: a hawkish undertone from the Federal Reserve's December 9-10 meeting, where officials revised their "neutral rate" estimates higher despite a 25-basis point cut, and sticky inflation data that kept real rate expectations elevated. Technical factors also weighed on the market, as concerns about the volume of Treasury issuance needed to fund the OBBA's fiscal deficits widened term premiums. Looking to 2026, the outlook favors a steepening yield curve. The Fed is expected to cut rates to the 3.0%–3.25% range to support a softening labor market, which should anchor short-term yields. However, long-end yields (10-year+) are likely to remain sticky above 4.0% due to persistent inflation floors and the sheer supply of sovereign debt. The primary driver of returns will likely be income ("carry") rather than significant price appreciation, with volatility stemming from data dependence on inflation prints rather than recession signals.

Figure 1: U.S. Treasuries illustrating recent relative weakness.

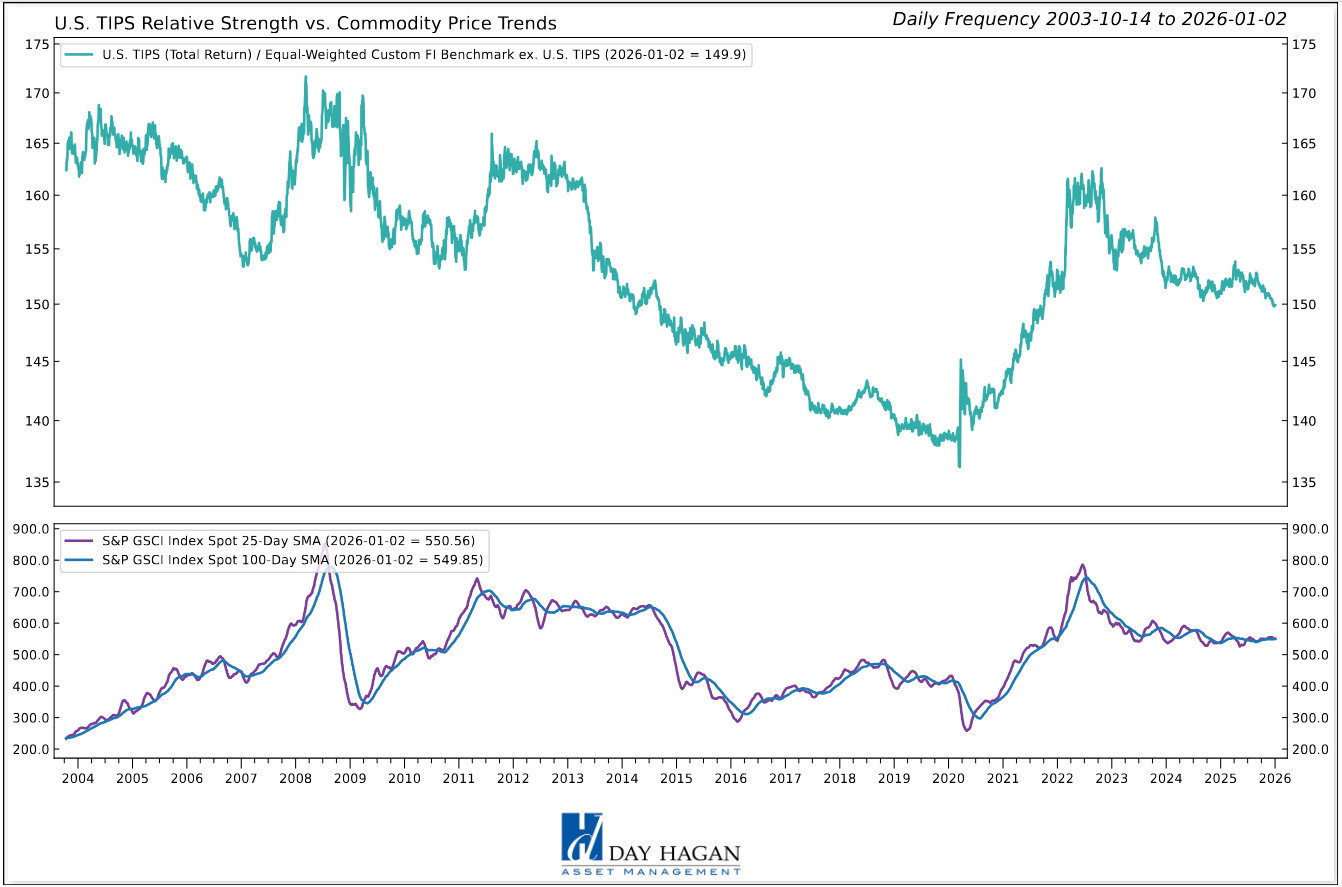

U.S. TIPS: U.S. TIPS indicators are mixed and point to a broadly neutral setup. On the positive side, relative strength versus technical RSI has turned supportive, suggesting short-term oversold conditions have eased. In addition, the relationship to commodity price trends is constructive, indicating that firmer input prices are helping stabilize inflation-linked assets and limiting downside pressure. On the negative side, momentum mean reversion and moving-average signals remain unfavorable, suggesting that medium-term trends remain weak. The link to high-yield credit spreads is also negative, implying that TIPS are not being used as a preferred risk hedge. Finally, relative strength versus inflation expectations is unfavorable, suggesting that breakeven inflation is not rising enough to drive strong demand. Overall, these crosscurrents argue for a modestly positive stance: near-term technicals and commodities provide some support, but broader trend and macro signals limit the case for a sustained overweight.

Commentary: U.S. Treasury Inflation-Protected Securities (TIPS) faced headwinds in December 2025 as real yields rose. While nominal Treasury yields fluctuated, breakeven inflation rates—the market's gauge of expected inflation—narrowed slightly due to cooler-than-expected energy prices and a momentary lull in tariff-related anxiety. This compression hurt TIPS relative to nominal bonds, as the inflation accrual component offered less immediate protection than in prior months. However, the asset class found a floor late in the month as labor wage data suggested core services inflation remained sticky, reminding investors of the structural cost pressures still present in the economy. For 2026, TIPS are positioned as a critical portfolio hedge. With consensus forecasting inflation to stabilize around 2.5%–3.0% rather than returning to the Fed’s 2% target, TIPS offer valuable insurance against "sticky" service sector prices and potential tariff shocks. The key performance driver will be the path of real yields; if the Fed cuts nominal rates faster than inflation falls (a "dovish pivot"), real yields will decline, boosting TIPS prices. Conversely, a resurgence in commodity inflation would drive breakevens wider, allowing TIPS to outperform nominal Treasuries significantly.

Figure 2: The recent uptick in commodity prices is constructive for TIPS. Monitoring for signs that this is a longer-term reversal.

U.S. Mortgage-Backed Securities: U.S. mortgage-backed securities indicators skew constructive and support a relatively attractive view. On the positive side, relative strength versus the moving-average cross and RSI are both favorable, indicating improving price trends and momentum. The relationship to the 10-year Treasury yield is also supportive, suggesting MBS are benefiting from stable or easing rate conditions. In addition, the positive slope in relative strength suggests improving performance relative to competing fixed-income assets. On the negative side, relative strength versus high-yield spreads is unfavorable, implying MBS are not capturing flows during periods of rising credit risk appetite. The signal versus inflation expectations is also negative, indicating limited protection if inflation pressures re-accelerate. Overall, however, the balance of signals favors MBS: technical trends, momentum, and rate sensitivity are aligned positively, while the macro negatives are secondary. This supports a modestly constructive allocation bias rather than a defensive or underweight posture.

Commentary: U.S. Agency Mortgage-Backed Securities (MBS) underperformed Treasuries in December 2025, as heightened interest rate volatility kept spreads elevated. The "spread widening" was driven by fears of increased supply and limited demand from traditional buyers, such as banks, who remained on the sidelines due to regulatory capital constraints. Extension risk also plagued the sector; with the 10-year yield hovering above 4%, refinancing activity remained muted, keeping MBS portfolio durations longer than many investors preferred. This sensitivity to rate moves exacerbated volatility during the mid-month Fed meeting. The outlook for 2026 is cautiously optimistic. MBS spreads are currently elevated relative to the 10-year average, offering valuation support that could attract income-focused buyers once rate volatility subsides. The key driver will be the stabilization of the yield curve; a decline in rate volatility (the "MOVE Index") would reduce the prepayment risk premium embedded in MBS, allowing spreads to tighten and generate excess returns over Treasuries. However, if the Fed maintains a "higher-for-longer" stance, the sector may struggle to break out of its current trading range.

Figure 3: MBS OBOS indicators are neutral.

U.S. Floating Rate Notes: U.S. floating-rate note indicators are broadly supportive and point to a relatively attractive setup. On the positive side, relative strength versus the technical cross and momentum are both favorable, indicating an improving trend and sustained upside relative to other fixed-income assets. The positive relative-strength slope confirms that this outperformance is gaining traction rather than fading. The relationship to the OIS swap rate is also constructive, suggesting floating-rate notes continue to benefit from the current level and structure of short-term interest rates. On the negative side, relative strength versus volatility extremes is unfavorable, implying floating-rate notes tend to lag during sharp risk-off episodes when volatility spikes. This reflects their limited defensive appeal compared with duration assets in stress scenarios. Overall, however, the weight of the evidence remains positive. Trend, momentum, and rate sensitivity are aligned in favor of floating-rate notes, supporting a modestly constructive allocation stance despite their weaker behavior in volatility shocks.

Commentary: U.S. Floating Rate Notes (FRNs) delivered steady performance in December 2025, benefiting from their near-zero duration profile amidst interest rate volatility. With the Fed maintaining its benchmark rate range before the mid-month cut, FRN coupons reset at attractive levels, providing income without the price volatility seen in fixed-rate Treasuries. Corporate FRNs saw demand as investors sought to shield portfolios from the steepening yield curve, which pressured longer-duration assets. Spreads remained tight, reflecting the robust balance sheets of investment-grade issuers. Heading into 2026, the appeal of FRNs will shift from "capital preservation" to "income management." As the Fed continues its anticipated rate-cutting cycle to a neutral 3.0%–3.25% range, the headline yields on FRNs will naturally drift lower. However, they remain a vital tool for defensive positioning. If inflation proves stickier than expected and prevents aggressive Fed easing, FRNs will outperform fixed-rate bonds by avoiding duration losses. The primary risk is a "hard landing" scenario where credit spreads widen significantly, though high-quality issuers should remain insulated.

Figure 4: Relative technical support for Floating Rate Notes is showing early signs of improvement.

U.S. IG Corporates: U.S. investment-grade corporate bond signals are mixed but tilt modestly constructive. On the positive side, relative strength versus credit default swaps is favorable, indicating stable credit risk pricing and limited near-term default concern. Relative strength against the U.S. dollar is also supportive, suggesting that currency conditions are not acting as a headwind to foreign demand. The technical trend signal is positive, indicating that price action has improved and that momentum is no longer deteriorating. On the negative side, relative strength versus implied bond volatility is weak, showing sensitivity to changes in rate and spread volatility. Relative strength versus option-adjusted spreads is also negative, reflecting that spreads are not tightening enough to provide a tailwind. The mean-reversion signal is bearish, implying recent gains may be somewhat extended. Overall, however, improving technicals and contained credit risk offset volatility and spread concerns, leaving the asset class in a relatively attractive yet not aggressive positioning.

Commentary: U.S. Investment Grade (IG) corporate bonds posted positive total returns in December 2025, supported by a decline in intermediate yields and resilient credit spreads. Despite broader volatility in the Treasury market, IG spreads remained historically tight, reflecting investor confidence in corporate fundamentals. Demand was technically driven, as pension funds locked in attractive all-in yields (averaging near 5.2%) before year-end, while issuance volume slowed seasonally, creating a supportive supply-demand imbalance. However, total returns lagged slightly behind Treasuries in weeks when "risk-off" sentiment spiked amid tariff headlines. For 2026, the IG sector is positioned as a "carry" trade. With spreads already tight, capital appreciation from spread compression is unlikely. Instead, returns will be driven by the 5%+ coupons. The key risk is "re-leveraging"—companies taking on debt for M&A or buybacks in a lower-rate environment, which could deteriorate credit metrics. Conversely, if the economy achieves a "soft landing," the sector’s high quality offers a sweet spot between the safety of Treasuries and the default risk of high yield.

Figure 5: Lower implied bond volatility is constructive for bonds and equities.

U.S. High Yield: U.S. high yield signals are broadly supportive. Relative strength versus the technical trend, total return moving averages, and the small-cap equity trend are all positive, indicating improving price action and alignment with broader risk appetite. The signal versus VIX trends is also favorable, suggesting that declining or stable volatility is helping credit risk assets. In addition, the option-adjusted spread reversal signal is constructive, implying that spreads are no longer widening and may be stabilizing or tightening, which supports carry-driven returns. The primary negative input is weakening high-yield bond breadth, indicating that fewer individual bonds are participating in the advance and that leadership is somewhat narrow. This limits conviction and raises the risk of short-term pauses. Even so, the combination of positive trend, volatility, and spread dynamics outweighs the breadth concern. Overall, the weight of the evidence points to a relatively attractive environment for U.S. high yield, with supportive risk conditions and contained credit stress, though some selectivity remains warranted. Focus on quality.

Commentary: U.S. High Yield (HY) bonds outperformed higher-quality segments on a duration-adjusted basis in December. The sector benefited from a "risk-on" rotation into lower-rated credits (CCCs) as economic data suggested a "no-recession" baseline, keeping default expectations low. Spreads tightened marginally, defying the volatility seen in equities, as the high carry (yields averaging over 6%) continued to attract yield-starved investors. However, the primary market was largely quiet, limiting supply pressure and supporting secondary market prices. The 2026 outlook for High Yield is bifurcated. While the all-in yields of ~6-7% are attractive, the "maturity wall" is a growing concern for lower-quality issuers, who face higher refinancing costs. Returns will likely be driven almost entirely by coupons, as tight spreads leave little room for price appreciation. The critical factor to watch is the labor market; any sharp rise in unemployment could trigger a widening of spreads, particularly in cyclical sectors like retail and industrials that are vulnerable to tariff impacts. Selection will be paramount over broad index exposure.

Figure 6: Small-cap performance pulled back to the 63-day moving average. Important support for High-Yield bonds.

International IG Bonds: Option-adjusted spreads, which are generally not widening and therefore do not point to rising default stress in the international investment grade universe. This suggests that fundamental credit risk remains contained and that carry remains available, even if price performance is soft. The negative signals dominate. Relative strength versus equity risk and volatility is weak, indicating underperformance when risk appetite rises. Trend measures, including the slope of relative strength and the moving-average cross, remain negative, indicating the asset class is in a downtrend relative to alternatives. The credit default swap signal is also unfavorable, suggesting no improvement in perceived credit quality. Taken together, the indicators point to a relatively unattractive setup for international investment-grade corporates, with weak relative momentum and trend outweighing the single supportive spread signal, and suggesting limited near-term return potential compared with other fixed-income or risk assets.

Commentary: Euro-denominated corporates outperformed their U.S. counterparts in local currency terms, as the ECB's dovish signaling anchored yields lower. However, for unhedged U.S. investors, the strengthening U.S. dollar (driven by the Fed's relative hawkishness) eroded these gains. Credit spreads in Europe widened slightly amid concerns about stagnation in Germany's manufacturing sector, contrasting with tighter spreads in the U.S. Heading into 2026, the case for International IG rests on diversification and ECB policy. With European yields likely to fall faster than U.S. yields as the ECB combats recession risks, the potential for capital appreciation is higher in Euro-credit. However, the "sovereign ceiling" risk remains; fiscal strains in peripheral Europe could spill over into corporate pricing. For U.S. investors, currency hedging will be the decisive factor—hedged exposure offers attractive yield pickup, while unhedged positions risk significant volatility from the USD/EUR exchange rate.

Figure 7: Watching to see if International IG Corporates MACD moves to a buy signal.

Emerging Market Bonds: The positive indicators are clustered around trend, relative performance, and risk appetite. Emerging-market U.S.-dollar bonds are showing relative strength versus EM currencies, suggesting that dollar-denominated credit is preferred to local FX exposure. They are also outperforming emerging equity momentum, indicating rotation into credit rather than equities. Trend signals are constructive, with the moving-average cross and the slope of relative strength both positive, pointing to improving price momentum and a stable uptrend. The primary negative signal stems from the relationship with commodity market strength, which is unfavorable and suggests that EM credit is not being driven by the commodity cycle and may lag in a reflationary or commodity-led environment. Even so, the balance of signals favors emerging market dollar bonds, with supportive trends and relative performance outweighing the single macro headwind, making the asset class look relatively attractive within global fixed income.

Commentary: Emerging Market (EM) bonds experienced a mixed December 2025, heavily bifurcated by issuer fundamentals. Hard-currency (USD-denominated) sovereign debt faced pressure from rising U.S. Treasury yields and a stronger U.S. dollar, which increased debt-servicing costs for weaker credits. Conversely, local currency bonds in countries with proactive central banks (like Brazil and Mexico) performed well, as their early rate-hiking cycles allowed for easing to begin, boosting bond prices. China-linked debt remained a drag, as skepticism over stimulus measures kept spreads wide in the Asian high-yield property sector. For 2026, the EM debt outlook is defined by the "weak dollar" thesis. If the Fed begins cutting rates as expected, the U.S. dollar may again soften, alleviating pressure on EM currencies and balance sheets. This would be a powerful tailwind for local currency debt, offering both yield and currency appreciation. The primary risk remains a "trade war" scenario; continued tariffs could hurt export-dependent EM economies, causing spreads to blow out regardless of Fed policy.

Figure 8: Emerging Market equity momentum has supported EM bond prices. This indicator is now negative.

Catastrophic Stop Model

The Catastrophic Stop model combines time-tested, objective indicators designed to identify high-risk periods for equities and fixed-income assets with high correlations to the equity market. The model entered January recommending a fully invested allocation relative to the benchmark for credit sectors with high correlations to equities.

The weight of the evidence suggests that any equity weakness is unlikely to extend into a significant downtrend at this time. Of course, if our model triggers a sell signal (below 40% for two consecutive days), indicating more substantial problems, we will reduce duration immediately.

Figure 9: The Catastrophic Stop model recommends fully invested equity and fixed income positions (relative to benchmarks). Because the model uses indices to extend its history, it is considered hypothetical.

Past performance is not indicative of future results. There can be no assurance that any investment or strategy will achieve its objectives or avoid substantial losses. This information is provided for illustrative purposes only and is not a prediction, projection, or guarantee of future performance. Hypothetical results do not reflect actual trading, were derived using the benefit of hindsight, and may not reflect material economic and market events.

The Day Hagan Daily Market Sentiment Composite (part of the Catastrophic Stop Model) remains in the “Excessive Pessimism” zone, reflecting a notable rise in investor caution. Sentiment remains excessively pessimistic based on our short-term model. This is viewed as a net positive from a contrary opinion perspective.

Figure 10: Investor sentiment is being reset, as illustrated by the DH Daily Market Sentiment Composite declining below 70. A reversal back above 30% would enhance the potential for a rally.

Our goal is to stay on the right side of the prevailing trend, introducing risk management when conditions deteriorate. Currently, the uptrend remains intact. The broader-based composite models calling U.S. economic growth, international economic growth, inflation trends, liquidity, and equity demand remain constructive. The Catastrophic Stop model is positive, and we are aligned with the message. If our models shift to bearish levels, we will raise cash.

This strategy utilizes measures of price, valuation, economic trends, monetary liquidity, and market sentiment to make objective, rational, and unemotional decisions about how much capital to place at risk and where to allocate that capital.

For more information, please contact us at:

Day Hagan Asset Management

1000 S. Tamiami Trl

Sarasota, FL 34236

Toll Free: (800) 594-7930

Office Phone: (941) 330-1702

Website: https://dayhagan.com or https://dhfunds.com

© 2026 Day Hagan Asset Management

This material is for educational purposes only. Further distribution is prohibited without prior permission. Please see the information on Disclosures and Fact Sheets here: https://dhfunds.com/literature. Charts with models and return information use indices for performance testing to extend the model histories, and they should be considered hypothetical. All Rights Reserved. (© Copyright 2026 Day Hagan Asset Management.)

Day Hagan Smart Sector® Fixed Income ETF

Symbol: SSFI

Disclosures

The data and analysis contained within are provided “as is” and without warranty of any kind, either express or implied. The information is based on data believed to be reliable, but it is not guaranteed. Day Hagan DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY, OR FITNESS FOR A PARTICULAR PURPOSE OR USE. All performance measures do not reflect tax consequences, execution, commissions, and other trading costs, and as such, investors should consult their tax advisors before making investment decisions, as well as realize that the past performance and results of the model are not a guarantee of future results. The Smart Sector® Strategy is not intended to be the primary basis for investment decisions, and the usage of the model does not address the suitability of any particular investment for any particular investor.

Using any graph, chart, formula, model, or other device to assist in deciding which securities to trade or when to trade them presents many difficulties, and their effectiveness has significant limitations, including that prior patterns may not repeat themselves continuously or on any particular occasion. In addition, market participants using such devices can impact the market in a way that changes the effectiveness of such devices. Day Hagan believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision and suggests that all market participants consider differing viewpoints and use a weight-of-the-evidence approach that fits their investment needs.

Past performance does not guarantee future results. No current or prospective client should assume future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals, and economic conditions may materially alter the performance of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s portfolio. Historical performance results for investment indexes and/or categories generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a portfolio will match or outperform any particular benchmark. Comparisons to indices are inherently unreliable indicators of future performance. The strategies used to generate the performance vary from those used to generate the returns depicted in the benchmarks. Investors cannot directly invest in an index.

The information contained herein is provided for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any security. The securities, instruments, or strategies described may not be suitable for all investors, and their value and income may fluctuate. Past performance is not indicative of future results, and there is no guarantee that any investment strategy will achieve its objectives, generate profits, or avoid losses.

This material is intended to provide general market commentary and should not be relied upon as individualized investment advice. Investors should consult with their financial professional before making any investment decisions based on this information.

The material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, forecasts, estimates of market returns, and proposed or expected portfolio composition. Day Hagan Asset Management, its affiliates, employees, or third-party data providers shall not be liable for any loss sustained by any person relying on this information. All opinions and views expressed are subject to change without notice and may differ from those of other investment professionals within Day Hagan Asset Management or Ashton Thomas Private Wealth, LLC.

Accounts managed by Day Hagan Asset Management or its affiliates may hold positions in the securities discussed and may trade such securities without notice.

Day Hagan Asset Management is a division of and doing business as (DBA) Ashton Thomas Private Wealth, LLC, an SEC-registered investment adviser. Registration with the SEC does not imply a certain level of skill or training.

There is no guarantee that any investment strategy will achieve its objectives, generate dividends, or avoid losses.

This material is for educational purposes only. Further distribution is prohibited without prior permission. Please see the information on Disclosures and Fact Sheets here: https://dhfunds.com/literature. Charts with models and return information use indices for performance testing to extend the model histories, and they should be considered hypothetical. All Rights Reserved.

All hypothetical results are presented for illustrative purposes only. Back testing and other statistical analysis is provided in use simulated analysis and hypothetical circumstances to estimate how it may have performed prior to its actual existence. The results obtained from "back-testing" information should not be considered indicative of the actual results that might be obtained from an investment or participation in a financial instrument or transaction referencing the Index. The Firm provides no assurance or guarantee that the products/securities linked to the strategy will operate or would have operated in the past in a manner consistent with these materials. The hypothetical historical levels have inherent limitations. Alternative simulations, techniques, modeling or assumptions might produce significantly different results and prove to be more appropriate. Actual results will vary, perhaps materially, from the simulated returns presented.

© 2026 Day Hagan Asset ManagementFuture Online Events