Day Hagan Smart Sector® with Catastrophic Stop Strategy Update November 2024

A downloadable PDF copy of the Article:

Day Hagan Smart Sector® with Catastrophic Stop Strategy Update November 2024 (pdf)

Catastrophic Stop Update

The Catastrophic Stop model combines time-tested, objective indicators designed to identify high-risk periods for the equity market. The model (Figure 1) declined toward the end of October but entered November with a fully invested equity allocation recommendation. If our models shift to bearish levels (below 40% for two consecutive days), we will raise cash.

Figure 1: Catastrophic Stop Model vs. S&P 500 Total Return Index

The model’s decrease was due primarily to the ACWI Breadth and Baltic Dry Index Factors turning negative, indicating that equity participation is narrowing and economic activity is moderating. Based on the changes, the Catastrophic Stop model has moved closer to neutral, setting it up to generate a sell signal more quickly if conditions warrant.

Figure 2: The ACWI Breadth Factor indicates that global equity participation has waned. Historically, the strongest uptrends have been supported by a broader range of stocks.

Figure 3: The Baltic Dry Index Factor has reversed to a sell signal (chart below). The Baltic Dry Index tracks rates for shipping dry bulk commodities and is often considered a leading indicator of economic activity. It measures 23 different shipping routes.

During the third quarter of 2024, the U.S. economy expanded at an annualized rate of 2.8%, slightly below the 3% forecast and Q2’s growth of 3%. The report showed that personal spending surged by 3.7%, the fastest increase since Q1 2023, driven by a remarkable 6% rise in goods consumption and steady service spending growth. Government consumption also increased significantly, up 5%, primarily due to defense spending. Net trade’s contribution improved, becoming less negative at -0.56 percentage points, aided by a sharp rise in exports (8.9%) and imports (11.2%). However, private inventories subtracted 0.17 percentage points from growth, while fixed investment slowed to 1.3%, influenced by declines in structures (-4%) and residential investment (-5.1%).

The S&P Global Flash U.S. Manufacturing PMI rose slightly to 47.8 in October, indicating continued contraction in the manufacturing sector but at a decelerating rate. Conversely, the Services PMI increased to 55.3, reflecting robust growth driven by new orders. Consumer sentiment was revised up to 70.5, its highest in six months, fueled by improving buying conditions for durable goods, partially due to easing interest rates. Expectations around the upcoming election affected consumer outlook, with confidence among Republicans rising as they believe a Trump presidency would positively impact the economy. Year-ahead inflation expectations remained steady at 2.7%.

Our U.S. Equity Model’s measures of momentum, mean reversion, breadth, volatility, ETF inflows, sentiment, relative forward earnings expectations, and the U.S. dollar remain supportive. Weaker manufacturing PMI trends and valuations are headwinds. The net result supports the view that the uptrend is intact—especially with many U.S. equity markets and sectors near all-time highs.

Equity markets are now entering a seasonally favorable time of year, even though U.S. elections will likely deliver a speed bump. Looking at the Dow Jones Industrial Average’s performance during different Presidential and Congressional Combinations since 1901, we note that a Republican President and Split Congress have historically had the lowest returns since 1901. However, that condition has only been in place 11.4% of the time, which is a relatively small sample size. A Republican President with a Republican Congress has historically been better for equities (7.3% annualized return, 22.7% of the time), as has a Democratic President with a Democratic Congress (7.0% annualized return, 33.9% of the time). Nonetheless, we take these kinds of studies with a grain of salt in that it is the policy initiatives that will most influence the financial markets, and getting a bead on what each party is actually promoting is proving elusive. At this point, the most glaring and “investable” difference would be around potential tax policy changes. Very simply, if corporate taxes are increased, stocks will suffer.

History shows that a “High Tax” environment does not support high valuation multiples. For example, when inflation is neutral (between 0% and 4%) and taxes are low, the S&P 500 typically traded around a 20.1x Price/Earnings ratio. However, when inflation was neutral and taxes were high, the average multiple dropped to 16.3x, which would equate to more than a 21% drop in prices from the multiple reset alone. (Source: Valens. Data from 1914-2020.)

With regard to tariffs and protectionism, it’s hard to say what the end results will be, given that the President has the authority to issue executive orders on tariffs and immigration. Nonetheless, using campaign rhetoric to make investment decisions has proven to be folly over the many election cycles in which we’ve participated.

We do note that, based on a historical, quantitative, and unemotional analysis, the monetary and fiscal policy index that we track (measuring economic liquidity) has increased, on average, during election years (tapering off toward the end of the year) and then entered a downtrend for the First and Second Presidential years. Note that even though stimulus declined, on average, during the First Presidential Year, the S&P 500 continued to move higher. It wasn’t until the 2nd Presidential Year that equities demonstrably weakened. We’ll continue to closely monitor stimulus and liquidity indicators for signs that the credit backdrop is tightening up. So far, credit conditions remain positive and the majority of global central banks are focused on more stimulative policies.

Figure 4: DJIA versus Presidential and Congressional combinations

Sector Outlook

Sector

Consumer Discretionary

Consumer Staples

Communication Services

Energy

Financials

Health Care

Industrials

Information Technology

Materials

Real Estate

Utilities

Outlook (relative to benchmark weighting)

Overweight

Neutral

Neutral

Neutral

Overweight

Underweight

Neutral

Neutral

Neutral

Neutral

Neutral

Sector Commentary

Sector Review

Consumer Discretionary: In October, stocks within the Consumer Discretionary sector experienced mixed outcomes amid economic pressures and shifting consumer habits. Key earnings highlights include Tesla’s (TSLA) stock surging by over 15% following robust third-quarter earnings and an optimistic sales growth forecast, significantly boosting the sector’s performance. McDonald’s Corp. (MCD) shares dropped approximately 5% amid concerns over an E. coli outbreak linked to its Quarter Pounder burgers, negatively impacting sector sentiment. eBay’s (EBAY) stock fell around 8% as the company projected lower-than-expected fourth-quarter revenue due to a challenging economic climate and cautious consumer spending. Tapestry’s (TPR) shares soared nearly 10% after a judge blocked its $8.5 billion acquisition of Capri Holdings. Overall, consumer spending was resilient. The composite model remained in positive territory with November’s update. Measures of trend, momentum, positive earnings surprises, and a reversal from short-term oversold conditions remained supportive during the month. We remain overweight.

Figure 5: Consumer Credit conditions remain supportive.

Consumer Staples: Kellanova (formerly Kellogg Company) reported stronger-than-expected third-quarter results, with net sales of $3.23 billion exceeding analysts’ forecasts of $3.16 billion and an adjusted profit of 91 cents per share, surpassing the expected 85 cents. In contrast, Kraft Heinz experienced a 2.8% decline in third-quarter net sales to $6.38 billion, falling short of Wall Street’s $6.42 billion estimate, primarily due to economic uncertainty and consumer price sensitivity; despite a 1.2% price increase, organic sales dropped by 3.4%. Meanwhile, Colgate-Palmolive posted higher-than-anticipated earnings, with net income rising to $737 million (90 cents per share) and adjusted earnings per share at 91 cents, alongside a 2.4% increase in net sales to $5.03 billion. Overall, consumer spending on essential goods remained stable despite inflation, although companies faced varying challenges with their pricing strategies. The composite model declined again this month, with negative overbought/oversold and breadth measures. This is in addition to negative readings based on prevailing credit conditions, food sales growth, the G10 Economic Surprise Index, and decelerating food inflation (pricing power). We modestly reduced exposure in response.

Figure 6: Relative breadth for the Consumer Staples sector continues to indicate broader-based relative weakness.

Communication Services: The S&P 500 Communication Services constituents displayed mixed performance in October but overall performed well. For example, Alphabet Inc. (GOOGL) saw its stock rise 2% pre-market, driven by substantial AI investments and a 35% increase in cloud business. However, other earnings reports offset the gains, including a 7% drop in AMD’s stock due to revenue forecasts falling short. Comcast Corporation (CMCSA) also gained, reporting third-quarter earnings that exceeded Wall Street expectations despite lower-than-anticipated broadband subscriber losses. It is contemplating a spin-off of its cable TV programming to capitalize on evolving media trends. Meanwhile, SBA Communications Corporation (SBAC) raised its annual adjusted funds from operations forecast, attributing this to strong demand for 5G services and plans to acquire over 7,000 communication sites for $975 million. The sector remains influenced by regulatory scrutiny and a shift towards AI-driven innovation. The composite model remains in neutral territory but did improve slightly with the November update, with a short-term trend measure turning positive. Relative valuations are still high, sales growth trends are negative, momentum is negative, and volatility is picking up. We remain neutral.

Figure 7: Relative price momentum is decelerating. Historically, this has been a headwind for the Communication Services sector.

Energy: Fluctuating commodity prices, geopolitical tensions, and company-specific developments combined for a volatile October. Notably, Exxon Mobil Corporation (XOM) saw its stock rise after its earnings release, despite analysts anticipating a 17% decline in Q3 EPS due to lower oil prices. Similarly, Chevron Corporation (CVX) experienced an increase yet is expected to report a 20% drop in EPS for Q3, attributed to lower crude prices and weaker refining margins. The company’s acquisition of Hess’s stake in the Guyana oil block suggests potential long-term growth. Conversely, First Solar, Inc. (FSLR) fell sharply after disappointing quarterly earnings. Meanwhile, Oklo Inc. (OKLO, in the Utilities sector), a nuclear startup, surged over 150% in October due to substantial contracts with tech giants for nuclear power, reflecting a growing trend towards sustainable energy solutions. Overall, fluctuations in crude prices and geopolitical instability in the Middle East have contributed to market volatility, impacting investor sentiment and energy company profitability. The composite model declined with the latest update but remained in the neutral zone. Like last month, momentum, overbought/oversold, and volatility measures are negative, but long-term breadth and trend indicators are supportive. Sentiment is in the middle of a 10-year range but directionally illustrates a buildup of pessimism. Should sentiment start to reverse from excessively pessimistic levels, indicating newfound and budding optimism, we would look to add exposure.

Figure 8: The Energy sector’s sentiment measure is in the process of reversing from levels denoting optimism. Once the indicator bottoms (showing extreme pessimism) and reverses, it has historically been an opportune time to add exposure.

Financials: The Financials sector was the second-best performer in October. Key players in the sector contributed significantly to this performance, with JPMorgan Chase & Co. (JPM) reporting a net income of $12.9 billion, a 2% decrease compared to last year but above analysts’ expectations, leading to a 4.4% rise in its stock price, bolstered by strong consumer banking revenues. Similarly, Wells Fargo & Co. (WFC) saw a net income decline of 11% to $5.1 billion, yet this also exceeded forecasts, resulting in a 5.6% stock increase due to higher net interest income. Bank of America Corp. (BAC) displayed a 9% increase in net income to $7.8 billion, thanks to rising interest rates. However, Goldman Sachs Group, Inc. (GS) faced a downturn in investment banking revenue, although growth in its wealth management division mitigated some losses. The positive interest rate environment, steady GDP growth, and low unemployment rates bolstered consumer confidence, promoting increased borrowing and financial activity. Overall, U.S. financial stocks exhibited strength, fueled by better-than-expected earnings and favorable economic conditions. The composite model improved due to lower relative volatility, the Citi Economic Surprise Index turning positive (meaning investors are potentially underestimating current levels of economic activity), and credit spreads (OAS) for financial companies narrowing. We increased exposure.

Figure 9: The G10 Economic Surprise Index has turned positive, indicating that investors are potentially underestimating the current levels of economic activity.

Health Care: The Health Care sector was the worst-performing sector in October. We had downgraded it in September primarily due to several technical indicators turning negative, including measures of short-term trend, momentum, and relative downside volatility. Earnings revision breadth had also reversed lower, joining the negative messages from measures of declining health care new construction and health care personal expenditures. The model deteriorated further with the November update, and we have downgraded the sector to underweight. Looking at earnings, Eli Lilly and Company (LLY) shares dropped after reporting third-quarter earnings that fell short of Wall Street expectations due to higher manufacturing costs and fluctuations in wholesaler levels for its anti-obesity treatment. In contrast, AbbVie Inc. (ABBV) reported robust third-quarter earnings driven by strong sales of its immunology drugs, which positively impacted its stock price and provided a lift to the sector. Johnson & Johnson (JNJ) maintained stability, reporting earnings that met analyst expectations, aided by its diversified portfolio that helped cushion against challenges in specific areas. Broader influences, such as ongoing regulatory scrutiny and potential policy changes, continued to shape investor sentiment, while advancements in biotechnology and recent drug approvals contributed positively to the performance of healthcare companies.

Figure 10: The weakness in healthcare stocks has caused healthcare sector credit spreads to widen, on average. Historically, this has been a headwind.

Industrials: The composite model declined but remained in the neutral zone. External indicators calling the operating environment for industrials show that valuations are relatively expensive and that higher commodity prices are negatively impacting profitability. The industrial production factor has also moved from bullish to neutral, illustrating the weakness in global manufacturing. Additionally, from a technical perspective, shorter-term momentum has rolled over. Reviewing earnings, Caterpillar Inc. (CAT) declined after third-quarter earnings missed expectations due to weak sales in the construction and resource industries. Caterpillar projected slightly lower sales and revenue for 2024, with CEO Jim Umpleby highlighting a continued decline in rental fleet loading and machine volume into the fourth quarter. Boeing Co. (BA) also faced stock pressure stemming from ongoing production issues, quality concerns, and a machinist union strike. Despite improving demand, Boeing struggled with regulatory scrutiny and production constraints. Meanwhile, General Electric Co. (GE) reported third-quarter earnings that met analyst expectations, aided by its diversified portfolio. Broader economic influences, such as Federal Reserve monetary policy and inflation rates, significantly affected consumer purchasing power, impacting industrial stocks, particularly those sensitive to interest rates in sectors like housing and automotive. Additionally, persistent supply chain disruptions continued to challenge production schedules and costs for many industrial firms, further influencing their financial performance.

Figure 11: Relative price momentum has turned negative.

Information Technology: The composite model improved, and we increased exposure to above benchmark. Measures of overbought/oversold, breadth, market-based inflation expectations, short interest, earnings revisions, and signs of life in emerging markets are positive. Valuations are still an issue. The S&P 500 Information Technology Index experienced notable fluctuations throughout October, initially buoyed by strong earnings from key players like Nvidia and Alphabet but later hampered by sell-offs. Nvidia Corporation (NVDA) surged ahead, surpassing Apple to become the world’s most valuable company with a market value of $3.53 trillion, fueled by soaring demand for its artificial intelligence (AI) chips. In October alone, Nvidia’s stock rose approximately 18%, driven by significant announcements like OpenAI’s $6.6 billion funding round, and the company’s shares reached record highs following robust quarterly results from Western Digital and TSMC. Comparatively, Apple, valued at $3.52 trillion, faced challenges with declining iPhone sales in China. Microsoft Corporation (MSFT) reported profits exceeding expectations; however, concerns over future growth in Azure led to a 5.6% decline in its stock. Despite Alphabet Inc.’s (GOOGL) 2% pre-market rise due to a 35% surge in its cloud business, mixed earnings dampened broader market gains. Overall, major tech companies, including Nvidia, Apple, and Microsoft, continue to dominate the S&P 500 index, reflecting both strong growth in AI and the challenges of fluctuating market conditions.

Figure 12: 50-day Net New Highs are increasing.

Materials: The sector was the second-worst performer in October. Measures of trend, overbought/oversold, volatility, natural gas futures, and valuations are negative. Conversely, Gold, Silver, and Copper trends are supportive. The net result is a neutral allocation. Albemarle Corporation (ALB) saw a 5% surge in shares after the U.S. approved a new lithium mining project, enhancing its production capacity to meet the rising demand from the electric vehicle sector. Similarly, Eagle Materials Inc. (EXP), a prominent construction materials producer, benefited from strong earnings reports and positive forecasts attributed to increased infrastructure spending and a thriving housing market. Freeport-McMoRan Inc. (FCX), a leading copper producer, reported earnings that exceeded expectations, fueled by soaring copper prices and growing production. This increase is largely due to heightened demand for copper in renewable energy initiatives and electric vehicles. Overall, the increment increases in government investment in infrastructure projects elevated the demand for construction materials, while the transition to renewable energy sources intensified the need for essential materials like copper and lithium, creating a favorable environment for companies across the sector. We’ll be watching the election closely as green initiatives represent a significant divergence in policy.

Figure 13: Emerging Market strength has historically been bullish for the Materials sector. Emerging Markets, however, have rolled over. If our technical indicators begin to show signs of renewed strength, we will reallocate accordingly.

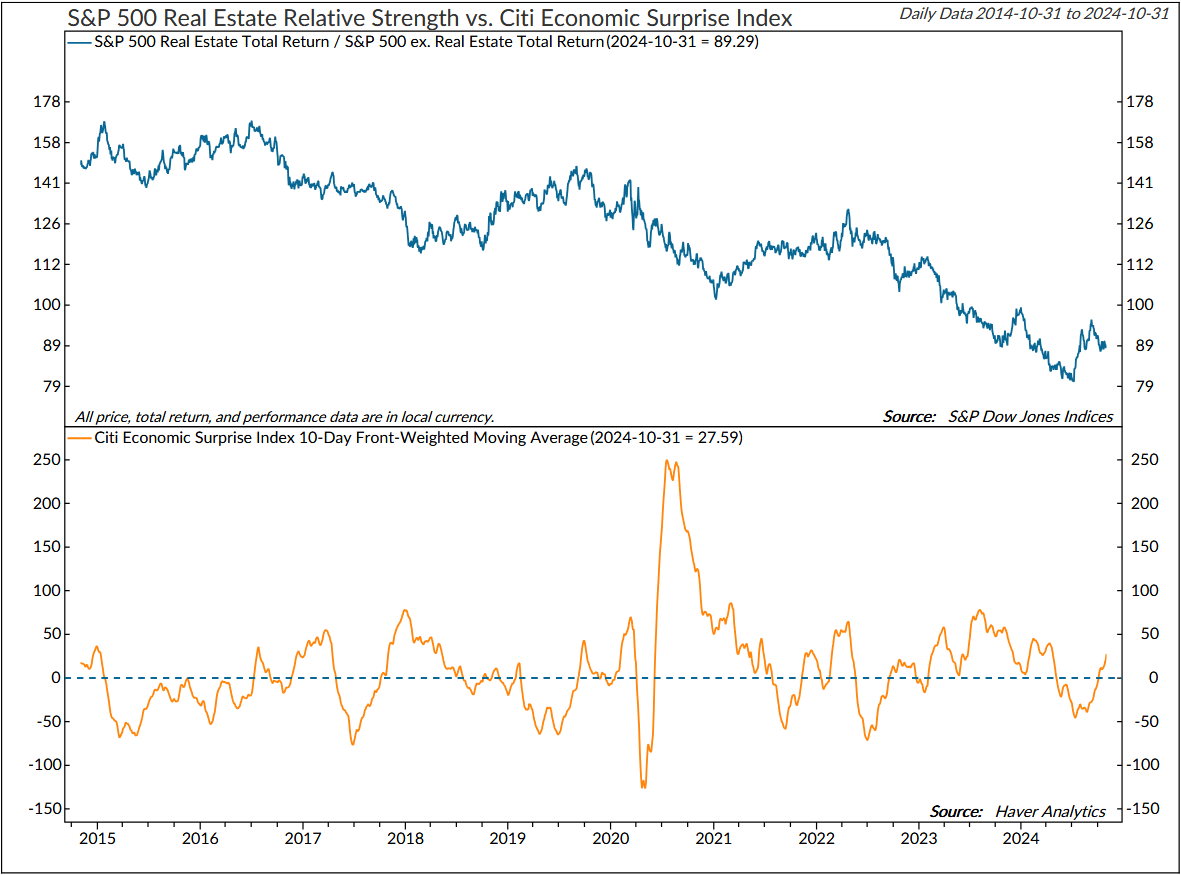

Real Estate: Although the sector had a rough October, the composite model increased primarily due to the Citi Economic Surprise Index turning positive. As discussed last month, the technical composite shows that the sector is primed for mean reversion as breadth indicators have started to improve. The technical improvement is supported by better homebuilder industry performance, industrial production for construction supplies picking up, positive business credit conditions, and the MBA Purchase Index showing better strength since August. Negative indicators include weak relative price trends, higher unemployment, and the recent backup in the 30-year Treasury yield. Kimco Realty Corporation (KIM) exceeded Wall Street expectations for its third-quarter funds from operations (FFO), reporting FFO of 43 cents per share. This was bolstered by robust leasing demand at grocery-anchored retail centers, attributed to a decline in new commercial space and heightened competition among retailers. Kimco raised its full-year FFO forecast to between $1.64 and $1.65 per share and increased its acquisitions forecast to $565 million to $625 million, significantly up from $300 million to $350 million. CBRE Group, Inc. (CBRE) also improved its full-year profit outlook, thanks to a 19% rise in global leasing revenue, including a notable 24% increase in the U.S. The company reported core adjusted earnings per share of $1.20, surpassing the $1.06 expectation. Realty Income Corporation (O) has emerged as another high-growth stock within the sector, evidenced by its consistent performance and strategic acquisitions. We are neutral.

Figure 14: When the indicator resides above 0, it indicates that investors have underestimated economic strength, which has historically been a constructive condition for the Real Estate sector.

Utilities: This month’s update leaves the composite model slightly lower, but still neutral. Both the internal and external composites are neutral. Bullish indicators include price trend, momentum, relative valuation to bonds, and the copper/gold ratio. Negative indicators include relative breadth (on a 50-day basis), some overbought conditions, and the yield on the Investment Grade Utilities sector declining and being less attractive relative to bonds. We remain neutral. NextEra Energy Inc. (NEE) reported a 9% increase in third-quarter earnings per share to $1.03, alongside a 5.5% revenue rise to $7.57 billion, surpassing analyst expectations. The company anticipates substantial profit growth, with earnings per share projected to reach between $3.23 and $4.32 by 2027. Exelon Corporation (EXC) also exceeded Wall Street forecasts, reporting adjusted operating earnings per share of 71 cents and quarterly revenue of $6.15 billion, driven by rising electricity rates and strong demand from data centers. Additionally, WEC Energy Group Inc. (WEC) posted adjusted earnings of 82 cents per share, buoyed by increased residential power usage and operational cost savings. Collectively, the sector’s growth has been propelled by a surge in energy consumption from AI and cloud computing innovations, alongside utilities’ ongoing investments in renewable energy sources, positioning them favorably amid the global shift towards sustainability.

Figure 15: Relative breadth has rolled over. A move below 10 and a reversal back above that level would be bullish.

Our goal is to stay on the right side of the prevailing trend, introducing risk management when conditions deteriorate. Currently, the uptrend remains intact. As has been the case for all of 2024, the broader-based composite models calling U.S. economic growth, international economic growth, inflation trends, liquidity, and equity demand remain constructive. The Catastrophic Stop model is positive, and we are aligned with the message. If our models shift to bearish levels, we will raise cash.

This strategy uses measures of price, valuation, economic trends, monetary liquidity, and market sentiment to make objective, unemotional, rational decisions about how much capital to place at risk and where to place that capital.

For more information, please contact us at:

Day Hagan Asset Management

1000 S. Tamiami Trl

Sarasota, FL 34236

Toll Free: (800) 594-7930

Office Phone: (941) 330-1702

Website: https://dayhagan.com or https://dhfunds.com

Charts courtesy Ned Davis Research (NDR). © Copyright 2024 NDR, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo.

Day Hagan/Ned Davis Research

Smart Sector® With Catastrophic Stop ETF

Symbol: SSUS

Disclosures

The data and analysis contained within are provided "as is" and without warranty of any kind, either express or implied. The information is based on data believed to be reliable, but it is not guaranteed. Day Hagan DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY, OR FITNESS FOR A PARTICULAR PURPOSE OR USE. All performance measures do not reflect tax consequences, execution, commissions, and other trading costs, and as such, investors should consult their tax advisors before making investment decisions, as well as realize that the past performance and results of the model are not a guarantee of future results. The Smart Sector® Strategy is not intended to be the primary basis for investment decisions and the usage of the model does not address the suitability of any particular in Fixed Income vestment for any particular investor.

Using any graph, chart, formula, model, or other device to assist in deciding which securities to trade or when to trade them presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves continuously or on any particular occasion. In addition, market participants using such devices can impact the market in a way that changes the effectiveness of such devices. Day Hagan believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision and suggests that all market participants consider differing viewpoints and use a weight-of-the-evidence approach that fits their investment needs.

Past performance does not guarantee future results. No current or prospective client should assume future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals and economic conditions may materially alter the performance of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s portfolio. Historical performance results for investment indexes and/or categories generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a portfolio will match or outperform any particular benchmark.

Day Hagan Asset Management is registered as an investment adviser with the United States Securities and Exchange Commission. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

There may be a potential tax implication with a rebalancing strategy. Re-balancing involves selling some positions and buying others, and this activity results in realized gains and losses for the positions that are sold. The performance calculations do not reflect the impact that paying taxes would have, and for taxable accounts, any taxable gains would reduce the performance on an after-tax basis. This reduction could be material to the overall performance of an actual trading account. Day Hagan does not provide legal, tax or accounting advice. Please consult your tax advisor in connection with this material, before implementing such a strategy, and prior to any withdrawals that you make from your portfolio.

There is no guarantee that any investment strategy will achieve its objectives, generate dividends or avoid losses.

© 2024 Day Hagan Asset Management