Day Hagan Smart Sector® International Strategy Update January 2025

A downloadable PDF copy of the Article:

Day Hagan Smart Sector® International Strategy Update January 2025 (pdf)

Catastrophic Stop Update

The Catastrophic Stop model combines time-tested, objective indicators designed to identify high-risk periods for the equity market. The model (Figure 1) held steady in December and entered January with a fully invested equity allocation recommendation. We will raise cash if our models shift to bearish levels (below 40% for two consecutive days).

Figure 1: Catastrophic Stop Model vs. S&P 500 Total Return Index

Figure 2: The Global Purchasing Manager Index is still in expansion territory. The recent moves higher for both manufacturing and services are encouraging.

Core: Developed Market Positions (approximately 65% of equity holdings)

Country

Australia

Canada

China

France

Germany

Japan

Switzerland

United Kingdom

Outlook

Neutral

Overweight

Underweight

Underweight

Neutral

Overweight

Overweight

Neutral

Explore: Emerging Market Positions (approximately 35% of equity holdings)

India

Taiwan

South Africa

South Korea

Mexico

Core: Developed Market Commentary

Approximately 65% of the strategy is allocated across eight of the largest markets in the ACWI ex-U.S. Index. The fund overweights and underweights the largest non-U.S. equity markets based on macro, fundamental, behavioral, and technical indicators. Weightings are determined using the Black-Litterman framework, which seeks to reduce volatility and enhance returns.

Australia: The Reserve Bank of Australia (RBA) maintained its cash rate at 4.35% during its final meeting of 2024, marking the ninth consecutive gathering without changes. This decision aligns with market expectations. While headline inflation in Australia has significantly decreased and is likely to remain low for the near future, underlying inflation continues to be elevated and is projected to reach the 2-3% target by 2026. Market speculation is increasing for potential rate cuts, with a roughly 50% chance of easing in February and a full quarter-point cut anticipated by April. The Australian dollar is hovering near its lowest level since October 2022. The currency faced pressure from rising U.S. Treasury yields, which surged to an eight-month high, coupled with a bearish market sentiment. The RBA’s dovish outlook on possible rate reductions has compounded the challenges. The Composite model deteriorated this month due to negative measures of trend, interest rate differentials, relative volatility, and valuations. We are neutral.

Figure 3: Looking for a reversal in the Australian Dollar.

Canada: The Bank of Canada (BoC) reduced its key interest rate by 50 basis points for a second consecutive month during its December meeting, aligning with market expectations and bringing the total cuts to 175 basis points from a peak of 5%. Despite this significant reduction, BoC officials signaled that more aggressive cuts are unlikely in the coming year and removed previous notes indicating potential further rate decreases if their base case holds. This decision followed the announcement that Canada’s GDP grew at an annualized rate of only 1% in the third quarter, falling short of central bank projections, with the fourth quarter also at risk of underperformance. However, indicators of consumer spending have surpassed expectations. The Canadian dollar neared its lowest point since March 2020 as investors reacted to weak GDP data and a strengthening U.S. dollar. Canada’s GDP is estimated to have contracted by 0.1% month-over-month in November, marking the first decline in 2023, and the government has revised growth forecasts downward for 2025 and 2026. This raises concerns that any further easing from the BoC could widen the interest rate differential with the U.S., diminishing the appeal of the CAD. The strengthening USD is bolstered by the Federal Reserve’s hawkish outlook, suggesting persistently high interest rates. Additionally, rising U.S. Treasury yields have dampened sentiment for mega-cap stocks, overshadowing recent Canadian market resilience driven by stronger commodities and gains in tech and real estate amid ongoing trade tensions and inflation concerns. Canada’s composite model declined with the latest update as trend indicators and the relative leading economic indicators rolled over. We reduced exposure and remain slightly overweight.

Figure 4: Investors expect more cuts from the Bank of Canada, but not as many as just a few months ago.

China: The People’s Bank of China (PBoC) has opted to maintain its key lending rates for the second consecutive month as of December, in line with market expectations. The one-year loan prime rate (LPR), a benchmark for corporate and household loans, has remained at 3.1%, while the five-year LPR, used primarily for property mortgages, holds steady at 3.6%. These rates are at historic lows following previous reductions in July and October. This decision coincides with Chinese leaders’ announcement to increase the 2025 budget deficit to 4% of GDP, the highest ever, to revitalize the economy and boost consumption. They also pledged a transition to a “moderately loose” monetary policy next year to tackle economic challenges. In China’s industrial sector, profits fell by 4.7% year-on-year in the first 11 months of 2024, intensifying from a 4.3% decline in the prior period. This downturn reflects persistent weak demand and deflationary pressures. Earlier in the week, the central bank infused CNY 300 billion into the financial system through one-year medium-term lending facility loans at 2%. China’s Composite model declined further with the January update, and we have moved to an underweight position. Measures of momentum, trend, economic activity, relative currency strength, and EM High-Yield credit spreads are negative.

Figure 5: High-yield credit spreads starting to widen from very low levels are a headwind for EM.

France: On December 4, Prime Minister Michel Barnier’s government was ousted in a no-confidence vote over proposed austerity measures for the 2025 budget, escalating political uncertainty in France. This upheaval raised investor apprehensions regarding the nation’s fiscal health and economic stability. In response, Moody’s downgraded France’s credit rating from Aa2 to Aa3, highlighting “materially weaker” economic outlooks and potential roadblocks in addressing the significant budget deficit. As a result, borrowing costs surged, with the 10-year bond yield exceeding 3%. The turmoil triggered a sell-off of French bonds, exacerbating the yield spread between French and German 10-year bonds, indicating heightened risks tied to French debt. The CAC 40 index saw declines amid this crisis, particularly impacting French banking stocks as investors reevaluated their vulnerability due to sovereign debt and economic instability. The inability to pass the 2025 budget, alongside reliance on emergency measures, heightened concerns about France’s capacity for effective fiscal policy implementation. Additionally, the HCOB Flash France Manufacturing PMI plunged to 41.9 in December 2024, the lowest since May 2020, reflecting a sharp contraction in manufacturing as production plummeted due to weak domestic and international demand. Employment also fell at an accelerated pace, with rising input prices contrasted by stagnant selling prices. Conversely, the HCOB France Services PMI increased to 48.2, yet it still indicated a contraction, marking four consecutive months of downturn. Service providers faced layoffs for the first time in nearly four years, compounded by weak demand and ongoing political instability, further dampening sales prospects. The Composite model remains negative, and we remain underweight.

Figure 6: The French manufacturing base is in a freefall.

Germany: Germany’s DAX index performed well this year, outpacing other European markets, with major contributions from companies like SAP, Siemens, and Allianz. Notably, SAP has driven nearly 40% of these gains, fueled by its shift to cloud services and growing interest in AI stocks. Despite this stock market rally, Germany’s economic growth forecast for 2025 has been revised down to just 0.6%, indicating a gap between market performance and actual economic conditions. Eurozone yields, particularly Germany’s 10-year bond, reached a one-month high of 2.32%, influenced by global central bank policies and expectations for rate cuts in 2025. The European Central Bank (ECB) suggested that the eurozone is approaching its medium-term inflation target, which could impact future monetary policy. Additionally, the U.S. stock market’s robust performance, spurred by technology stocks, has attracted global capital, strengthening the U.S. dollar by 7% and affecting European markets. Manufacturing in Germany remains under pressure, with the HCOB Manufacturing PMI falling to 42.5 in December, signaling a significant contraction. Conversely, the Services PMI rose to 51, suggesting a return to growth, though challenges persist, with costs rising and employment in the sector declining slightly. We are neutral and allocated modestly below the ACWX benchmark weighting due to negative trend, breadth, and valuation indicators.

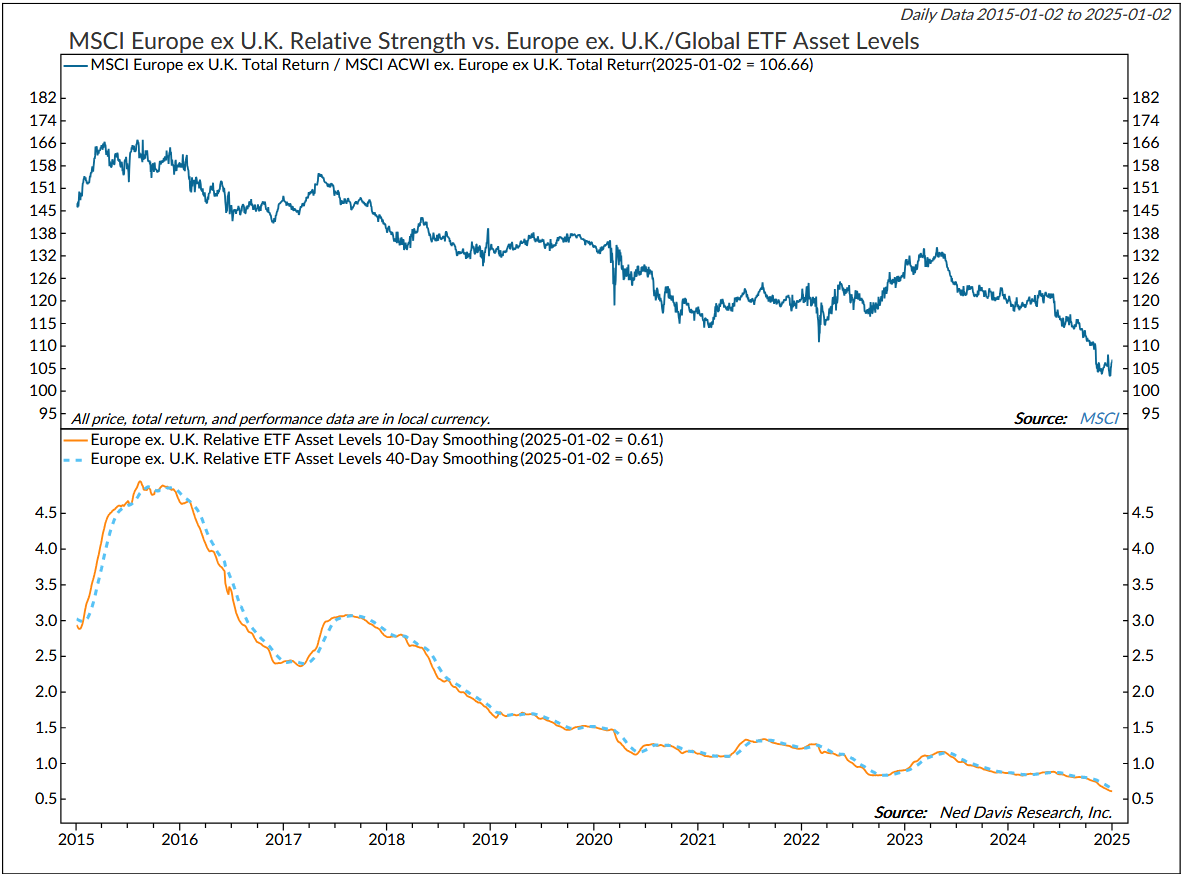

Figure 7: European bourses continue to be plagued by investor outflows (based on ETF AUM changes). Until this condition reverses, it will be difficult for the indexes to outperform their global peers.

Japan: The Bank of Japan (BoJ) opted to keep its key short-term interest rate steady at approximately 0.25% during its year-end meeting, marking the highest rate since 2008 and aligning with market expectations. Despite signs of weakness in some sectors, the BoJ continues to view Japan’s economy as undergoing a moderate recovery. Private consumption has been rising, supported by improved corporate profits and increased business investment. However, exports and industrial output have remained relatively stagnant. Inflation, measured year-on-year, has been hovering between 2.0% and 2.5%, driven primarily by rising service costs. Inflation expectations have seen a gradual uptick, with the underlying Consumer Price Index (CPI) expected to grow incrementally. The Japanese yen strengthened recently but remains close to a five-month low as investors analyzed the latest inflation figures and the BoJ’s December Summary of Opinions. Tokyo’s inflation surged to 3% in December, up from 2.6% in November, bolstering speculation around the bank’s potential interest rate increase. Moreover, the au Jibun Bank’s Japan Manufacturing PMI rose slightly to 49.5 in December, indicating a continued contraction in factory activity for six consecutive months. In contrast, the Services PMI improved to 51.4, reflecting growth in the service sector for the second straight month. Japan’s composite model improved and is now the second-highest ranked. Measures of trend and sentiment are reversing from overly pessimistic levels. We are adding again this month and are now overweight.

Figure 8: Sentiment has reversed from overly pessimistic levels, and optimism is building.

Switzerland: The Swiss National Bank (SNB) surprised markets by cutting its key policy rate by 50 basis points to 0.5% in December, marking the steepest reduction in nearly a decade. This decision was driven by a decline in inflation, which fell from 1.1% in August to 0.7% in November, attributed to lower costs in domestic services, oil, and food. Inflation is expected to average 1.1% in 2024 and remain within the SNB’s target range through 2026. Despite these rate cuts, the Swiss economy faces challenges, including rising unemployment, decreased production, and global uncertainties, affecting the forecasted GDP growth of around 1% for this year and an anticipated increase to 1-1.5% in 2025. In November 2024, the procure.ch Manufacturing PMI decreased to 48.5 from 49.9 in October, below expectations of 49.4. Key indicators such as production, order books, and employment contracted, while purchasing volume and delivery times showed slight improvements. We have modestly increased exposure to an overweight position.

Figure 9: A reversal in the U.S. dollar would be very bullish for the Euro, British Pound, and Swiss Franc, especially with them at such oversold levels.

United Kingdom: The euro is nearing a two-year low and down nearly 6% in 2024 due to differing central bank expectations. After the European Central Bank (ECB) cut rates to 3% for the fourth time, President Christine Lagarde noted the eurozone is “very close” to its inflation target. While overall inflation dropped to 2.2%, services inflation remains high at 3.9%. Conversely, the Federal Reserve anticipates only two rate cuts in 2025, strengthening the dollar amid Trump’s potential policy changes. In December 2024, the European Central Bank (ECB) reduced its key interest rates for the fourth time this year, cutting by 25 basis points amid a more optimistic inflation outlook and improved monetary policy implementation. Forecasts suggest inflation will gradually decline, with anticipated rates of 2.4% in 2024, 2.1% in 2025, and 1.9% in 2026. Core inflation, excluding volatile energy and food prices, is targeted at 2% in the medium term. While the cut eases financing conditions, borrowing costs remain elevated due to the lingering impact of previous interest rate hikes. Economic recovery appears sluggish, with growth projected at 0.7% for 2024, 1.1% for 2025, and 1.4% for 2026. The HCOB Eurozone Manufacturing PMI stood at 45.2 in December, unchanged from the previous month and below expectations of 45.3, marking a continued contraction in the manufacturing sector for two years. Declines in new orders have led factories to reduce output significantly, particularly in Germany and France, despite a decrease in work backlogs. Conversely, the HCOB Eurozone Services PMI improved to 51.4 from 49.5, indicating a rebound in service sector activity following a contraction in November. However, new orders still fell, and job growth nearly stalled while both input and output prices surged sharply. The region’s composite model is neutral, and we are modestly increasing exposure to a benchmark weight position.

Figure 10: The U.K. Recession Probability Model indicates a low probability of recession. If the series moves above 30, it would be concerning.

Emerging Market Positions

Approximately 35% of the strategy is allocated across five markets from a pool of more than 20 smaller markets. Selection is based on a multifactor technical ranking system using trend and mean reversion indicators.

Current Holdings:

India

Taiwan

South Africa

South Korea

Mexico

Explore: Emerging Market Commentary

India: The Reserve Bank of India (RBI) held its key repo rate steady at 6.5% for the 11th consecutive meeting in December, responding to market expectations while adopting a neutral stance amid slowing economic growth. The RBI also reduced the Cash Reserve Ratio (CRR) by 50bps to 4%, the first cut since April 2020, to enhance liquidity ahead of advance tax payments. The introduction of the Secured Overnight Rupee Rate (SORR) aims to bolster the interest rate derivatives market. GDP growth for FY 2025 is now projected at 6.6%, down from 7.2%, while inflation is expected to rise to 4.8%, compared to previous estimates of 4.5%. The Indian rupee fell to a record low of 85.5 per USD, a 2.5% decline this year, driven by capital outflows and expectations of a rate cut. Domestic inflation fell to 5.5% in November, allowing room for potential rate cuts by March 2025. Meanwhile, both the HSBC Manufacturing and Services PMIs showed strong growth, indicating robust year-end factory and service sector performance. India also surpassed China in IPO activity in 2024, marking it as Asia’s top market.

Taiwan: During its December 2024 meeting, the Central Bank of the Republic of Taiwan maintained its key discount rate at 2%, aligning with market expectations. The board believes this stability will promote overall economic growth and maintain financial stability. The bank revised its 2024 GDP growth forecast to 4.25%, up from 3.82% in September, and expects a slight increase to 3.13% in 2025. Citing potential uncertainties from the incoming Trump administration’s trade policies, it adjusted its inflation forecast for this year to 2.18% and projected a drop to 1.89% in the following year.

South Africa: On November 21, 2024, the South African Reserve Bank lowered its key interest rate by 25 basis points to 7.75%, marking the lowest borrowing costs since April 2023. The bank maintained its economic growth forecast for 2024 at 1.1% while slightly increasing its 2025 projection to 1.7% and keeping the 2026 forecast steady at 1.8%. The RMB/BER business confidence index also showed positive trends, rising to 45 in Q4 2024, up from 38 in the previous quarter, the highest level since Q1 2022. This increase in sentiment was largely attributed to improved business conditions, enhanced activity, stable electricity supply, and political stability. All sectors, except new vehicle sales, experienced growth, with building contractors seeing a notable surge to 51 and wholesale trade rising to 60. The manufacturing and retail sectors also showed improvements, climbing to 36 and 54, respectively. This positive shift in business confidence reflects the gradual advancements in reforms. Additionally, South Africa assumed the G20 presidency on December 1, making it the first African nation in this role, a move that likely bolstered investor optimism regarding future economic opportunities and global engagement.

South Korea: The South Korean won gained strength as Acting President and Finance Minister Choi Sang-mok emphasized his commitment to stabilizing the nation’s financial markets. Choi called on financial agencies to respond quickly and decisively to any increased volatility. This reassurance comes amid ongoing political instability, marked by attempts to detain impeached President Yoon Suk Yeol following his controversial declaration of martial law in early December. In December 2024, South Korea’s Manufacturing PMI fell to 49, down from 50.6 in November, indicating the third contraction in four months and a significant downturn for the sector. The decline was attributed to a drop in new orders and a sluggish domestic economy, compounded by rising cost pressures. Meanwhile, the KOSPI Index surged nearly 2% on Friday, January 3, climbing above 2,440 and recovering from a three-week low as investors appeared to overlook the political chaos. The market rally was bolstered by Choi’s proactive stance on financial stability, reinforcing the government’s intent to manage economic challenges amidst turbulent times.

Mexico: In December 2024, the Bank of Mexico made the unanimous decision to reduce its benchmark interest rate by 25 basis points to 10%, marking a continuation of its easing cycle as anticipated. This move aligns with global trends of disinflation, though inflation remains stubborn in major economies, especially in service sectors. Following a period of weakness, Mexico’s economic activity showed signs of recovery in the third quarter; however, forecasts suggest a slowdown is likely heading into 2025 due to decelerating employment and lingering downside risks. Inflation figures reflected some easing, with headline inflation decreasing to 4.55% in November from October’s 4.76%, while core inflation dropped from 3.80% to 3.58%. The bank indicated that additional rate cuts may be warranted, potentially in greater increments, depending on the pace of disinflation and overall economic conditions. Meanwhile, the S&P Global Mexico Manufacturing PMI stood at 49.8 in December, impacted by declining new orders and job cuts, though easing cost pressures provided a glimmer of hope.

This strategy utilizes measures of price, valuation, economic trends, monetary liquidity, and market sentiment to make objective, unemotional, rational decisions about how much capital to place at risk and where to place that capital.

For more information, please contact us at:

Day Hagan Asset Management

1000 S. Tamiami Trl

Sarasota, FL 34236

Toll Free: (800) 594-7930

Office Phone: (941) 330-1702

Website: https://dayhagan.com or https://dhfunds.com

© 2025 Day Hagan Asset Management

Charts courtesy Ned Davis Research (NDR). © Copyright 2025 NDR, Inc. Further distribution is prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers, refer to www.ndr.com/vendorinfo.

Day Hagan/Ned Davis Research

Smart Sector® International ETF

Symbol: SSXU

Strategy Description

The Smart Sector® International strategy combines three quantitative investment strategies: Core International, Explore International, and Catastrophic Stop.

The Process Is Based On The Weight Of The Evidence

Core Allocation

The fund begins by overweighting and underweighting the largest non-U.S. equity markets based on proprietary models.

Each of the models utilizes market-specific, weight-of-the-evidence composites of fundamental, economic, technical, and behavioral indicators to determine each area’s probability of outperforming the ACWI, for example. U.S. Markets are weighted accordingly relative to benchmark weightings.

Explore Allocation

To select smaller markets, the fund uses a multi-factor technical ranking system to choose the top markets. The markets with the highest rankings split the non-core model allocation equally.

When Market Risks Become Extraordinarily High — Reduce Your Portfolio Risk

The model remains fully invested unless the Catastrophic model is triggered, whereupon the equity-invested position may be trimmed by up to 50%.

The Catastrophic Stop model combines time-tested, objective indicators designed to identify periods of high risk for the broad U.S. equity market. The model uses price-based, breadth, deviation from trend, fundamental, economic, interest rate, behavioral, and volatility-based indicator composites.

When Market Risks Return To Normal — Put Your Money Back To Work

When the Catastrophic Stop model moves back to bullish levels, indicating lower risk, the strategy will reverse toward being fully invested.

Disclosures

The data and analysis contained within are provided "as is" and without warranty of any kind, either express or implied. The information is based on data believed to be reliable, but it is not guaranteed. Day Hagan DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY, OR FITNESS FOR A PARTICULAR PURPOSE OR USE. All performance measures do not reflect tax consequences, execution, commissions, and other trading costs, and as such, investors should consult their tax advisors before making investment decisions, as well as realize that the past performance and results of the model are not a guarantee of future results. The Smart Sector® Strategy is not intended to be the primary basis for investment decisions and the usage of the model does not address the suitability of any particular in Fixed Income vestment for any particular investor.

Using any graph, chart, formula, model, or other device to assist in deciding which securities to trade or when to trade them presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves continuously or on any particular occasion. In addition, market participants using such devices can impact the market in a way that changes the effectiveness of such devices. Day Hagan believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision and suggests that all market participants consider differing viewpoints and use a weight-of-the-evidence approach that fits their investment needs.

Past performance does not guarantee future results. No current or prospective client should assume future performance of any specific investment or strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals and economic conditions may materially alter the performance of your portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for a client’s portfolio. Historical performance results for investment indexes and/or categories generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment management fee, the incurrence of which would have the effect of decreasing historical performance results. There can be no assurances that a portfolio will match or outperform any particular benchmark.

Day Hagan Asset Management is registered as an investment adviser with the United States Securities and Exchange Commission. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

There may be a potential tax implication with a rebalancing strategy. Re-balancing involves selling some positions and buying others, and this activity results in realized gains and losses for the positions that are sold. The performance calculations do not reflect the impact that paying taxes would have, and for taxable accounts, any taxable gains would reduce the performance on an after-tax basis. This reduction could be material to the overall performance of an actual trading account. Day Hagan does not provide legal, tax or accounting advice. Please consult your tax advisor in connection with this material, before implementing such a strategy, and prior to any withdrawals that you make from your portfolio.

There is no guarantee that any investment strategy will achieve its objectives, generate dividends or avoid losses.

© 2025 Day Hagan Asset Management